6 minutes 10 May 2024

This is the third post in the series “The Promise of Blockchain.” If you haven’t read the others, you can find them here.

In the last post we looked at how Bitcoin came to be, what it’s intended use case was and how it’s currently performing for that use case. The goal of this post is to simply help you understand three fundamental features of Bitcoin so that you understand why it’s such a big deal today.

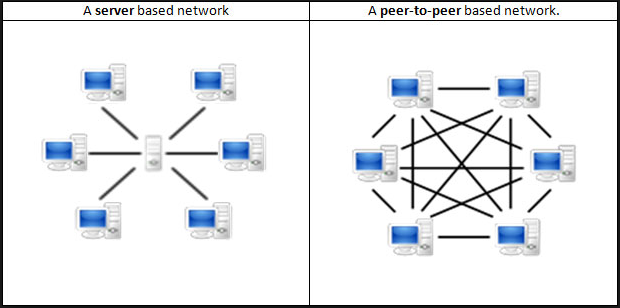

Peer to Peer Network

At the core of Bitcoin’s design is it’s peer to peer network. In this network, information is shared directly between participants instead of going through a central point.

Here’s how it works:

- When you send a Bitcoin transaction, you don’t send it directly to the recipient. Instead, you broadcast it to the entire Bitcoin network.

- This broadcast is picked up by computers around the world, called nodes. These nodes pass the information along, ensuring it remains accurate as it spreads across the network.

- Special participants in the network, called miners, gather these transactions and work to add them to the blockchain by creating blocks. This process involves verifying the transactions and solving a complex puzzle. Once a block is successfully mined, the transactions it contains are confirmed and permanently added to the blockchain.

- After validation, your transaction becomes an unchangeable part of Bitcoin’s public ledger, visible to all but controlled by no one.

This system removes the need for a central authority like a bank to oversee and verify transactions. It’s what makes Bitcoin decentralized and resistant to control by any single entity.

Proof of Work Consensus Mechanism

While the peer to peer network enables transactions, it’s the consensus mechanism that ensures the security and integrity of the Blockchain. Proof-of-Work(PoW) is the consensus mechanism used by the Bitcoin network to determine which miner gets to add the next block of validated transactions to the blockchain.

Imagine the Bitcoin network as a giant, global race. Every 10 minutes, a new race starts. The participants are computers all around the world, running special Bitcoin software. These computers are called miners.

Here’s how the PoW mechanism works:

- Transaction Broadcast: When you make a Bitcoin transaction, it gets broadcast to the network and joins a pool of unconfirmed transactions, aka the mempool

- Block Creation: Miners gather these transactions and package them into what we call a “block.”

- Puzzle Solving: Miners must solve a complex mathematical puzzle to add this block to the blockchain (our public ledger). This puzzle is designed to be hard to solve but easy to verify.

- Competition: Miners around the world compete to solve this puzzle first. The first one to solve it gets the right to add the new block to the blockchain.

- Rewards: The winning miner gets some newly created bitcoin as a reward for their effort (and electricity bill). This is how new Bitcoin enters circulation.

So what’s the point in even going through all of this?🤔 Well, it’s Bitcoin’s way of ensuring security and consensus without a central authority.

This is why it works:

- Deterring Cheating: It’s expensive and time-consuming to participate, which deters cheating.

- Difficulty Adjustment: The puzzle’s difficulty adjusts automatically to ensure blocks are added at a consistent rate, regardless of how much computing power is used.

- Security: Once a block is added, it’s computationally impractical to alter it without redoing all the work for that block and all blocks after it.

This system makes tampering with the Bitcoin ledger very difficult and expensive. To cheat the system, you’d need to control more than half of the network’s computing power—a scenario that’s economically just not practical.

In essence, Proof-of-Work replaces trust in a central authority with trust in the laws of mathematics and economics. It keeps Bitcoin secure and trustworthy without needing a bank or government to oversee it.

Limited Supply (21 Million Cap)

You’ve probably heard that governments can print money whenever they want.

Need to pay for a war? Print money. Economic crisis? Print money. This ability to create currency out of thin air is why you hear people complain about inflation and the decreasing value of money over time. But Bitcoin? It plays by different rules.

Bitcoin has a fixed supply cap of 21 million. That’s it. No more, no less. This isn’t just a promise or a policy - it’s hardcoded into Bitcoin’s DNA. Here’s how it works:

- Controlled Release: New Bitcoin is created as a reward for miners (remember those special participants solving complex puzzles?). But these rewards aren’t constant.

- Halving Events: Every 210,000 blocks (roughly every four years), the reward for mining a block is cut in half. This is called a “halving.”

- Diminishing Supply: At the time of writing, miners get 3.125 bitcoins per block. In 2028, it’ll be 1.526. This halving continues until all 21 million bitcoins are mined.

- Final Bitcoin: Based on this schedule, the last bitcoin is expected to be mined around the year 2140.

So why is this limited supply such a big deal?

Scarcity: Bitcoin’s limited supply is often compared to gold. Just as there’s a finite amount of gold on Earth, there will never be more than 21 million bitcoins in existence. This scarcity is a key factor in determining Bitcoin’s value.

Predictability: Unlike fiat currencies, everyone knows exactly how many bitcoins will ever exist.

Inflation Resistance: No government or central bank can decide to “print” more bitcoin, potentially protecting it from inflation.

It’s important to note that scarcity alone does not automatically guarantee value. The value of Bitcoin, similar to any currency or asset, ultimately relies on people perceiving it as valuable and being willing to use or invest in it.

In essence, Bitcoin’s limited supply is a huge shift from how we’ve traditionally thought about money. It’s an experiment in digital scarcity that aims to create a new kind of “sound money” tailored for the digital age.

Wrapping Up

Bitcoin’s fundamental features—peer-to-peer networking, Proof of Work consensus, and limited supply—have revolutionized our concept of money since its 2009 beginnings. From the first real-world transaction of 10,000 BTC for two pizzas in 2010, to its current status as a global financial phenomenon, Bitcoin has consistently challenged traditional notions of currency and value. While Bitcoin opened the door to decentralized digital currencies, it was just the beginning of the blockchain revolution.

In the next post, we’ll explore how Ethereum built upon Bitcoin’s foundation, introducing the concept of a “world computer” and smart contracts. These innovations expanded blockchain’s potential, enabling a wide range of applications far beyond digital currency and setting the stage for a new era of decentralized technology.

If you want to stay updated with the latest posts, consider subscribing to my newsletter. You can do this by clicking the button below.

Liked this post? Share it using the links below